For months, global markets have been preoccupied with the US-China trade war. Lately, protests and riots in Hong Kong (one of the world’s largest financial centers) have added even more uncertainty into the mix. Even as the residents of that city continue to rally against Chinese control, a third story may be just as important to your investments – a story, however, that has been underplayed by the mainstream financial news here in the US.

For months, global markets have been preoccupied with the US-China trade war. Lately, protests and riots in Hong Kong (one of the world’s largest financial centers) have added even more uncertainty into the mix. Even as the residents of that city continue to rally against Chinese control, a third story may be just as important to your investments – a story, however, that has been underplayed by the mainstream financial news here in the US.

This year, Halloween will be scary for a reason other than witches or goblins. October 31 is also the deadline for the United Kingdom to leave the European Union and currently, that exit looks like it might follow one of the worst case paths. Let’s look at what’s going on and how we can prepare ourselves for that contingency.

Brexit Could Happen Three Ways

Brexit originated not too long ago in 2016 when the British narrowly voted to leave the EU in a national referendum. This was the first of the “populist uprising” votes in various countries across the globe in recent years. Since that referendum, the Brexit process has been convoluted, confusing, and badly managed (on all sides) which has delayed the event time and time again.

Numerous parties involved seem unable (or unwilling) to agree on how to implement Brexit. Critical issues such as trading terms between the EU and UK are supposed to be settled in a deal before Brexit happens. Getting a deal that everyone likes, however, has proven impossible.

On May 24th, Theresa May announced that she would resign if she couldn’t push through a deal. She then failed to convince the British Parliament to accept her latest version of an exit deal so she resigned as Prime Minister on June 7th. The main sticking point was the border status between Northern Ireland (a part of the United Kingdom) and the Republic of Ireland (a member of the EU).

As both Ireland and the UK are currently members of the EU, there are no border checks or other obstacles for travelers or for trade across this border. In fact, you might have no idea that you’re leaving one country and entering another in northern Ireland. That very open border has taken the wind out of the sails of those who fought in “the Troubles” – the civil war between those who wanted Northern Ireland to stay in the UK and those who wanted it to join Ireland.

May’s successor as Prime Minister, Boris Johnson, pledged to renegotiate her deal, but those negotiations failed. As British and EU law currently stand, the UK will automatically leave the EU on October 31 whether there’s a deal or not. The UK could exit the EU through three different scenarios or three “kinds” of Brexit. You may have heard of these when people use the term – a “soft,” “hard,” or “no-deal” Brexit. Let’s look at these three possibilities.

Under a “soft Brexit,” the UK would basically stay in the EU’s common trade and customs zone with trade and travel mostly unchanged. For most companies and individuals, a soft Brexit would change everyday life little and would be the least disruptive option for the markets. Theresa May’s deal would have been a hybrid soft Brexit.

“Hard Brexit” is the name for what would happen if the UK leaves the EU without a finished or complete trade deal. The EU is the UK’s largest trading partner so this kind of exit would be very challenging for British companies. Why? Under a hard Brexit, the transition from free trade with the EU to potentially no trade would happen instantly on midnight, October 31. A hard Brexit leaves no transitional period to ease companies’ trade with their EU suppliers, partners, and customers. In fact, no one is quite sure what will happen in the short or intermediate term with this kind of an exit.

That’s a lot of uncertainty and as we know, markets dislike uncertainty most. The turmoil in the markets when this happens could hit select stocks hard upon a Brexit at the end of October but . . .

Uncertainty Over What’s Next is Already Hurting Stocks

As of right now, the UK is set to leave the EU on October 31 without any deal – which everyone refers to as a “no-deal Brexit”. In reality, a no-deal Brexit is just a form of a hard Brexit.

That’s why starting to protect your portfolio right now from companies either based in the UK or with a lot of UK exposure is crucial. The closer we get to Brexit without any kind of deal, the riskier staying in these stocks is going to be – but trade with the EU is not the only worry. Once the UK leaves the EU, it also must begin negotiating trade deals with all the other countries around the world with which it previously traded under EU terms. After a hard Brexit, the United Kingdom will be desperate for a trade deal with a major trading partner.

Probably the most important trade deal after a hard Brexit would be with the US. Here, British companies may well lose out again because the UK will be negotiating with President Trump, someone who likes to play hardball in trade negotiations. He might not go so easy on the British.

The British Parliament just passed a law requiring the Prime Minister to ask the EU to postpone Brexit again. In the meantime, there will be a general election, and a new government will be allowed to try to negotiate with the EU.

Or at least that’s the plan. If the three-year-long saga has shown anything, though, it’s that Brexit plans keep getting delayed and diverted. Delaying Brexit again will only extend the uncertainty for the eventual separation from the EU. Brexit uncertainty isn’t waiting, however, for its effects to be felt. Companies are at risk of losing business now and some stocks’ prices are experiencing effects now. Luckily, there are a few ways you can protect your portfolio from this mess today.

Ahead of Brexit, Avoid These Stocks

As one of the world’s main financial centers, a number of financial companies would be hurt by a hard Brexit. Bank of New York Mellon Corp. (BK), for example, gets 15% of its revenue from the UK.

HSBC Holdings plc (HSBC), one of the world’s largest banks, originates from Hong Kong with headquarters in London putting it at risk from both a hard Brexit and fallout from the demonstrations in Hong Kong. The bank is already paying up to $300 million to relocate 1,000 employees from London to Paris. According to its own estimates, HSBC could lose $1 billion in revenue over a hard Brexit.

The London Metal Exchange acts as the world’s largest gold exchange and as a major exchange for many other metals so gold mining companies may also be in for a rough ride. Newmont Goldcorp Corp. (NEM) especially is at risk as 75% of its revenue comes from the UK.

Other companies with a large exposure to the UK include eBay Inc. (EBAY) and PayPal Holdings Inc. (PYPL). eBay is a very popular way to shop online in the UK and it uses PayPal as its payment system. Under a hard Brexit, the lack of a trade deal with the EU would lead to difficulties sending payments and goods across the border – hitting the revenues of both companies hard.

British airlines such as Ryanair Holdings plc (RYAAY) would also suffer when travel to and from the UK becomes more difficult.

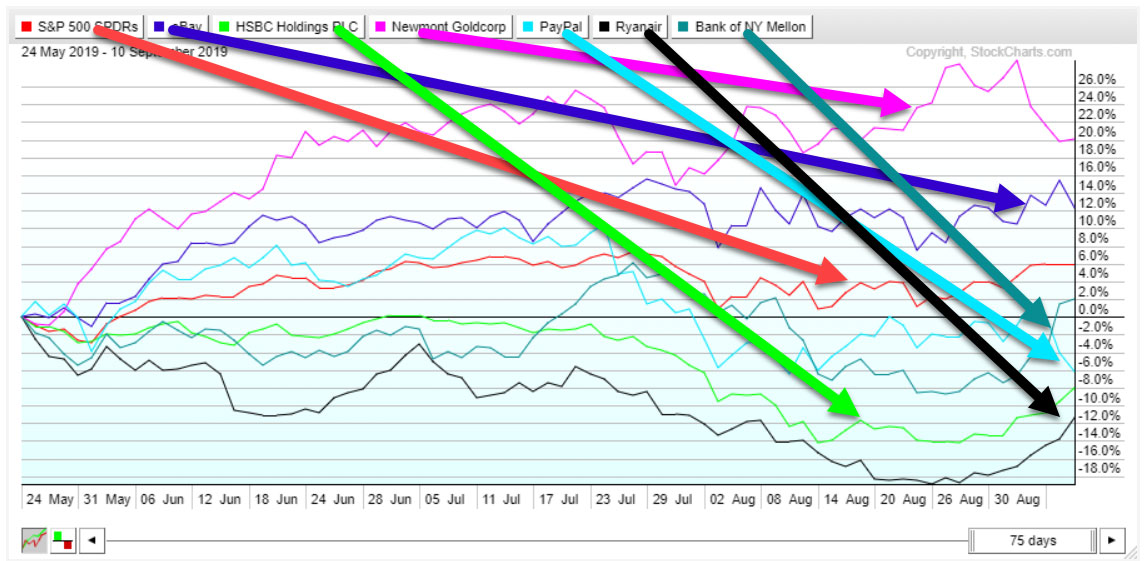

Here’s a chart showing how all of those companies (and the S&P as tracked by SPY) have fared since the day Theresa May announced she would step down:

Since May resigned, you can see that HSBC, RYAAY, and PYPL are under water despite the UK rebound in the last week and a half. For the other three symbols, BK just edged up above breakeven for the period while EBAY found some footing and the big jump in gold prices powered NEM over the summer. I’d be leery of Newmont being able to hold those gains if Brexit issues can’t be worked out.

Meanwhile, US-based competitors to these companies may well prosper under a hard Brexit especially if the US and UK strike a trade deal favorable to America.

I’ll talk more about the U.S. sectors and stocks in a future article. Until then, I always love to hear from you. Send me an email at: drbarton “at” vantharp.com.

Great trading and God bless you,

D. R.